*_…as bank secures CBN accreditation_*

By Itoro Bassey

Akwa Savings and Loans Limited (ASL) has been recognized as the top e-Channel mortgage bank in South-South Nigeria, an accolade bestowed by Interswitch, a leading fintech service provider specializing in payment solutions.

This honor follows the bank’s recent accreditation by the Central Bank of Nigeria (CBN) as a Primary Mortgage Bank, authorized to manage Federal Housing Fund (FHF) activities, a program executed by the Federal Mortgage Bank of Nigeria (FMBN).

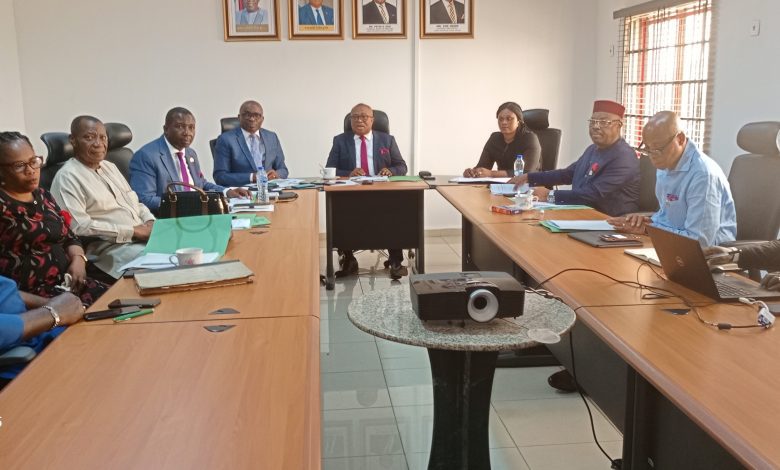

Pastor Ime Okon, the bank’s Managing Director/Chief Executive Officer, made the disclosure on Wednesday during the 147th board meeting of the bank in Uyo.

Pastor Okon also highlighted the remarkable progress the bank has made in the past two years, following its recapitalization and the appointment of a new board by the Akwa Ibom State Government in 2021.

The Akwa Ibom State-owned mortgage bank, once struggling, has made an impressive recovery. According to Pastor Okon, the bank has been revitalized, reoriented, and fortified for further growth.

“Our e-channel is robust and efficient. It has increased operational convenience for our customers to transact with their debit cards using any bank ATM and POS. We have engaged POS merchants to improve services to our customers”, he stated.

Okon maintained that the bank marked a milestone by recording its first profit in 29 years in 2021, a trend that continued into 2022 and is projected to yield a significant profit by the end of 2023.

“We are marching towards greater growth. Also, we achieved a N1 billion benchmark in annual revenue in 2022 and 2023. We have disbursed over N1 billion tied-to-business loans to our customers”.

ASL’s turnaround can be attributed to the expertise of its board members, including Pastor Peter Udo, a corporate finance and management expert; Pastor Ime Okon, former CEO of Keystone Bank, Sierra Leone; Mr. Linus Nkan, a chartered accountant and seasoned banker; Mr. Okon Okon, a chartered banker, public finance expert and chartered tax professional; Pastor Imo-Abasi Jacob, an investment banker, chartered accountant and certified financial planner; Mr. Michael Akpan, a chartered banker and expert in infrastructure financing; and Mrs. Ekaette Udoh, a specialist in cooperative society management.

With such a talented team, the Managing Director said the bank is ready to launch its first series of affordable low-income prefab houses and is currently financing the Uyo Ultramodern International Market at Mbiabong Etoi, in Uyo.

“We are working to roll-out the first set of our affordable, low income prefab houses at our estate at Ekom Iman by the end of 2024. The bank has already signed Memorandum of Understanding (MOU) with a Chinese and Nigerian-based developers to kick-start the prefab estate”.

The Managing Director encouraged the public to benefit from the bank’s diverse offerings by opening an account at any of ASL’s five branches.

He assured customers that their deposits are secure, as the bank has established robust internal control measures and corporate governance mechanisms to ensure its sustainability and profitability.

“ASL is poised to offer Akwa Ibom people the best services in mortgage financing. We call on members of the public to walk in and open an account at any of the five branches of Akwa Savings and Loans Limited. Your deposit is secured”, Okon added.

Meanwhile, ASL is set to hold its inaugural Annual General Meeting (AGM) next year, marking another significant milestone in its journey towards growth and success.

Related posts

Categories

- Advertisements (1)

- Agriculture (46)

- Breaking News (26)

- Business (599)

- Crime (994)

- Education (322)

- Entertainment (128)

- Features (13)

- For The Records (43)

- Foreign News (1,203)

- Health (220)

- Home News (332)

- Interview (9)

- Judiciary (354)

- Lifestyle (140)

- Local News (112)

- National News (1,449)

- Opinion (26)

- Politics (1,019)

- Religion (158)

- Science and Technology (125)

- Security (687)

- Sports (883)

- States' News (824)

- Transportation (331)

- Uncategorized (10)